Why Do Drilling Rig Prices Vary? Key Factors Affecting Costs Explained

The complexities of the drilling industry are reflected not only in the technology and techniques employed but also in the fluctuating costs associated with drilling rigs. Understanding the nuances of "Drilling Rig Price" is essential for industry stakeholders, whether they are buyers, sellers, or investors. This article delves into the key factors that contribute to variations in drilling rig prices, shedding light on the elements that drive costs up or down.

From the rig's specifications, age, and condition to market demand and economic conditions, several variables influence the pricing landscape. The interplay between supply and demand, geographic location, and the specifics of the drilling project all play significant roles in determining the final cost incurred by operators. Moreover, advancements in technology and deployment of new materials can also shift price structures, making it vital to stay informed about the trends.

By examining these factors, stakeholders can better navigate the market, make informed decisions, and anticipate future fluctuations in drilling rig prices. Ultimately, a comprehensive understanding of these dynamics will empower industry players to optimize their investments while enhancing operational efficiency.

Factors Influencing Drilling Rig Prices: An Overview

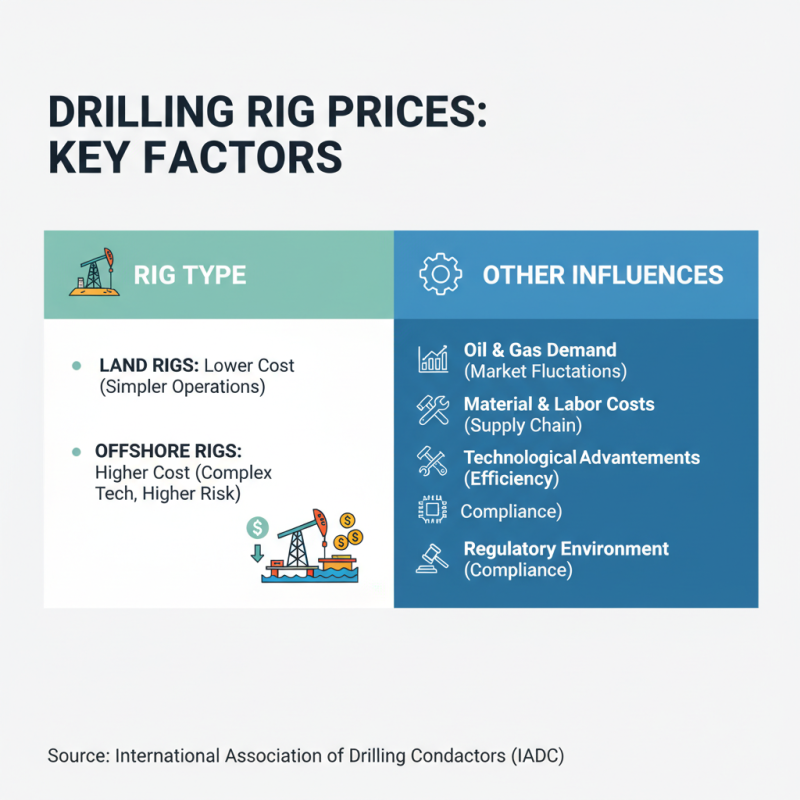

Drilling rig prices can fluctuate significantly due to a variety of factors that influence costs across the industry. One of the primary determinants is the type of rig required for a specific project. For example, land rigs generally cost less compared to offshore rigs, largely due to the complexities and additional technologies involved in offshore drilling operations. According to a report by the International Association of Drilling Contractors (IADC), the average daily rate for offshore rigs can be several times higher than that of land rigs, reflecting the higher risks and operational costs associated.

Another key factor influencing drilling rig prices is the current state of the oil and gas market. Prices are often tied to demand for energy resources and geopolitical stability, which can lead to fluctuations in rig utilization rates. In times of high demand, operators may face increased competition for rigs, leading to higher prices. The 2022 Energy Outlook report from the Energy Information Administration (EIA) highlighted that a 10% increase in oil prices could result in a corresponding surge in rig day rates by up to 15%, showcasing the strong correlation between market trends and rig costs.

**Tip:** To secure the best drilling rig prices, consider contracting during off-peak seasons when demand is lower, allowing for more negotiating power and potentially lower rates.

Furthermore, the age and condition of the rig also play critical roles. Newer rigs equipped with advanced technology tend to demand higher prices due to their efficiency and lower operational costs. Conversely, older rigs might offer cheaper options but could entail higher maintenance expenses and lower performance levels. According to a report by Baker Hughes, maintenance costs for older rigs can increase by 30% compared to newer counterparts, impacting the total cost of ownership significantly.

**Tip:** Always evaluate the total cost of ownership rather than just the initial price; this includes maintenance, efficiency, and expected downtime.

Types of Drilling Rigs: Cost Variations Explained

The cost of drilling rigs can vary significantly based on several types that serve different purposes within the industry. For instance, land drilling rigs typically range from $100,000 to over $1 million, depending largely on their capabilities and the depth they can reach. In contrast, offshore drilling rigs are considerably more expensive, with prices that can exceed $600 million for advanced floating units. According to a report from the International Association of Drilling Contractors (IADC), the cost variation can be attributed to factors such as rig type, technological advancements, and specific geographic challenges.

The operational capacity and specifications of drilling rigs also play a significant role in their pricing. For example, a high-specification rig designed for deep-water drilling might have additional features like dynamic positioning systems, which increase both safety and efficiency, but also contribute to higher costs. Additionally, market conditions, such as the demand for oil and gas, impact prices as seen in the 2021 downturn, which led to a significant depreciation in rig values by approximately 30%. Understanding these variations is crucial for companies making investment decisions in drilling technology.

Market Demand and Supply: Impact on Pricing

Market demand and supply play pivotal roles in determining the prices of drilling rigs. According to a report by the International Association of Drilling Contractors (IADC), fluctuations in oil prices significantly influence drilling activity and, consequently, demand for rigs. When oil prices rise, exploration and production activities typically ramp up, resulting in increased demand for drilling rigs. Conversely, during periods of low oil prices, operators may scale back their drilling operations, leading to an oversupply of rigs in the market and driving prices down. For example, a recent analysis indicated that during 2022, regions with increased natural resource exploration experienced a 15% rise in rig utilization, while areas with reduced drilling activity saw a corresponding 20% decline, which starkly illustrates the correlation between market dynamics and rig pricing.

Additionally, the availability of skilled labor and technological advancements also contribute to rig pricing variations. The Organization of Petroleum Exporting Countries (OPEC) reports that a skilled workforce is essential for the efficient operation of drilling rigs, and regions facing labor shortages often see higher operating costs, which can increase rig prices. Furthermore, the integration of advanced technologies, such as automation and real-time data analytics, can enhance rig efficiency and lower operational costs, potentially stabilizing prices. Overall, these factors create a complex interplay of supply and demand that ultimately shapes the drilling rig market, making it crucial for industry stakeholders to continuously monitor market trends to make informed investment decisions.

Why Do Drilling Rig Prices Vary? Key Factors Affecting Costs Explained - Market Demand and Supply: Impact on Pricing

| Cost Factor | Impact Level | Description |

|---|---|---|

| Market Demand | High | When the demand for oil and gas rises, drilling rig prices tend to increase due to higher competition for rigs. |

| Economic Conditions | Medium | Fluctuations in the global economy can cause variations in investment levels in drilling operations. |

| Rig Specifications | High | Advanced technology and features in rigs can significantly increase costs. |

| Location | Medium | Rigs located in remote or challenging areas may face higher operational costs. |

| Regulatory Environment | Low | Changes in regulations can have a minimal impact on rig prices depending on compliance costs. |

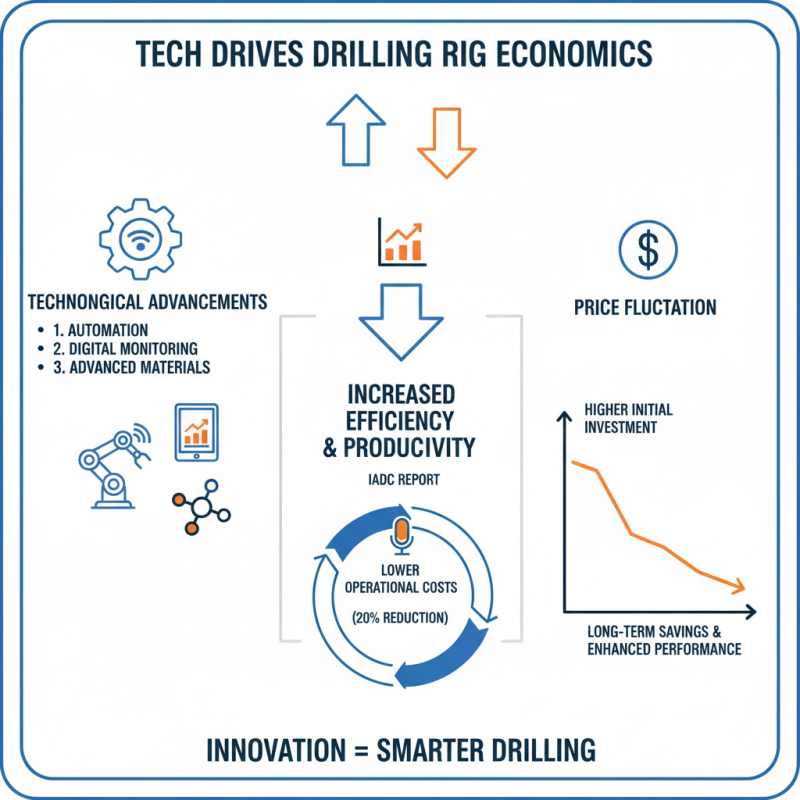

Technological Advances: Their Role in Cost Fluctuations

Technological advances play a critical role in the fluctuation of drilling rig prices. With the rise of automation, digital monitoring, and advanced materials, the overall efficiency and productivity of drilling operations have increased significantly. According to the International Association of Drilling Contractors (IADC), companies that adopted new technologies reported a 20% reduction in operational costs. This shift means that while initial investments in advanced rigs may be higher, the long-term savings and enhanced performance often justify the expense.

However, it's essential to recognize that not all technological improvements yield the same return on investment. The ongoing evolution in drilling methods, such as the use of rotary steerable systems and real-time data analytics, can lead to varying price structures as companies seek to incorporate the latest innovations. The U.S. Energy Information Administration (EIA) noted that specific drill types, particularly those utilizing hybrid technologies, can command premium prices due to their capability to optimize drilling time and resource extraction.

Tips: When exploring rig options, assess how each rig's technology can impact your overall operational costs. Investing in a technologically advanced rig may offer savings in the long run, despite a higher upfront price. Additionally, collaborating with suppliers who prioritize R&D can provide insights into which innovations are likely to deliver the best cost-benefit ratio for your specific drilling projects.

Geographic Considerations: How Location Affects Rig Costs

The location of a drilling rig significantly influences its cost, primarily due to geographic considerations. Different regions present unique challenges and varying operational expenses that can drive up or lower the overall price. For example, rigs operating in remote or offshore locations often face higher logistical costs, including transportation of equipment and skilled labor. Additionally, the availability of necessary infrastructure, such as roads, ports, and utilities, can also affect expenses. In areas where access is limited, companies may need to invest more in establishing a base of operations, leading to increased initial costs.

Moreover, regulatory frameworks and local economic conditions play crucial roles in determining drilling rig prices in specific areas. Regions with stringent environmental regulations may require additional compliance measures, thus raising operational costs for drilling companies. Conversely, locations with favorable tax incentives or lower taxation levels may offer cost advantages, attracting more drilling activities. Ultimately, the interplay of geographic variables—from natural resource availability to workforce accessibility—shapes the financial landscape of drilling rig pricing, making it essential for companies to evaluate these factors when planning their operations.

Related Posts

-

Best 10 Ventilator Machines You Should Know About

-

Unlocking the Darkness: Why Mining LED Headlamps Are Essential for Modern Miners

-

What is Pneumatic Equipment? Understanding Types and Applications Explained

-

Top 5 Benefits of Using Mini Submerged Pumps for Efficient Water Management

-

The Ultimate Guide to Choosing the Best Electric Rock Drill for Your Projects

-

10 Best Mining Lamp Chargers: Power Up Your Adventure Efficiently!